Your way to CMA Holder

CMA NEWS

Certified Management Accountant (CMA) exam has 2 parts: Part 1 and Part 2.

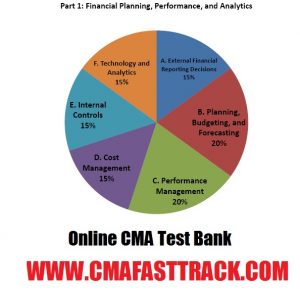

CMA exam part 1 coverage breakdown

| A. External Financial Reporting Decisions | 15% |

| B. Planning, Budgeting, and Forecasting | 20% |

| C. Performance Management | 20% |

| D. Cost Management | 15% |

| E. Internal Controls | 15% |

| F. Technology and Analytics | 15% |

CMA exam part 2 coverage breakdown

| A. Financial Statement Analysis | 20% |

| B. Corporate Finance | 20% |

| C. Decision Analysis | 25% |

| D. Risk Management | 10% |

| E. Investment Decisions | 10% |

| F. Professional Ethics | 15% |

This is the roadmap:

1@ Requirements for taking the test:

a- bachelor’s degree

b- membership of the Institute of Management Accountants (IMA)

c- Two years of work

d- Exam for Part 1 and Part 2 of the CMA

2@ How it coast?

IMA memberships have 3 different types and annual fee: Professional $230, Academic $120, Student $39 and all + one-time $15 fee.

3@ How to study?

You can be Self-study offline courses and online courses.

#cmafasttrack

#cma_fasttrack

4@ How to Pass CMA Exam?

You need to study for 16 weeks (25 hours a week) for each part. And take mock exams until your score is become 80%: visit our Test Bank www.cmafasttrack.com

👇

How to Meet the CMA Exam Requirements؟

As the administrator of the Certified Management Accountant (CMA) certification, the Institute of Management Accountants (IMA) holds high standards for CMA candidates. And to enforce these standards, the IMA has established the Certified Management Accountant requirements (or CMA requirements), some of which also serve as the CMA exam requirements.

Compared to those of other professional accounting certifications (such as the CPA), the CMA requirements are fairly straightforward and simple. However, they do require time and effort to complete. Furthermore, you must finish some of the CMA qualifications before others. Therefore, you should learn about the CMA certification requirements and the CMA exam requirements before you start the process of pursuing the CMA.

To earn the CMA certification, you must fulfill these 7 CMA requirements in this order:

Hold active membership with the IMA

Pay the CMA entrance fee

Fulfill the education qualification

Pass both parts of the CMA exam

Fulfill the experience qualification

Comply with the IMA Statement of Ethical Professional Practice

Complete the annual CPE requirements

As you can see, some of these requirements are more involved than others. For example, paying the CMA entrance fee, and complying with the statement are pretty quick and easy steps.

However, meeting the education requirement, completing the experience requirement, and passing the CMA exam demand much more concentration and commitment. Therefore, many CMA candidates focus the most on the 3 requirements that start with an e: education, exam, and experience.

Addressing the CMA Requirements in Order

To properly satisfy each CMA requirement, you must address them in the right order.

1. Become an IMA member and pay the CMA fees

The very first step to earning the CMA is becoming an IMA member, which involves filling out a short application and paying a fee. The type of IMA membership you’ll hold and the price you’ll pay for it depends on your current professional status. Your IMA membership type and fee options are as follows:

Professional: $245

Academic: $135

Student: $39

The next step in the CMA certification process is paying the CMA entrance fee. You must pay this fee in order to enter the CMA program and take the CMA exam. And the price of this fee depends on your IMA membership type. Professional IMA members must pay $250, while Academic and Student members have to pay $188.

Once you enter the CMA program, you have 3 years from the date of entry to pass the CMA exam. If you don’t pass both CMA exam parts within 3 years, you will lose credit for any parts you passed, and you’ll have to pay the CMA entrance fee again.

The CMA Handbook provided by the IMA states that, along with access to the CMA exam, the CMA entrance fee also includes:

Access to the CMA Support Package beginning on the date of entry into the CMA program

Performance feedback reports

Review of educational and experience credentials

Final score report upon completion of the exams

Personalized, numbered certificate upon completion of all requirements

Employer notification of achievement if desired

Maintenance of a listing of all CMAs in good standing on the IMA website for employer verification of status

2. Meet the CMA exam requirements

The CMA exam requirements include:

Completing the education qualification

Passing the CMA exam

You can take the CMA exam before you complete the education requirement, as the IMA accepts student members and offers them discounts on CMA exam fees. However, you must submit verification of your education to the ICMA within 7 years of passing the CMA exam.

CMA Education Requirement

CMA candidates can satisfy the education requirement in 1 of 2 ways:

Earn a bachelor’s degree from an accredited college or university

You’ll find a partial list of accredited U.S. and international institutions here: http://univ.cc/world.php.

If you received your degree from a non-accredited institution, an independent agency must evaluate your education. You’ll find a list of such agencies at aice-eval.org or http://www.naces.org/members.htm.

If you can’t find your college or university on the accredited listing, you can contact the IMA at ima@imanet.org.

The IMA clarifies that verification of a bachelor’s degree means all transcripts should be mailed directly from your college or university to the address below.

If you cannot submit your transcripts, the Institute of Certified Management Accountants (ICMA) asks that you mail them a notarized copy.

Have a professional certification

The IMA has a list of approved professional certifications.

The IMA elucidates that verification of a professional certification means the approved certifying organization should mail a letter confirming that you are a qualified member directly to the address below.

All of your education verification must be submitted in English, and you must include your IMA member number. The address to which transcripts an

Each part of the CMA exam features 2 types of questions and a specific number of each:

You’ll have 4 hours of total testing time for each exam part, divided like this:

You must answer at least 50% of the MCQs correctly to be eligible to move on to the essay section. If you are eligible, the exam will present the essays to you after you’ve answered all of the MCQs or after 3 hours have passed, whichever comes first. Once you leave the MCQ section of the exam, you can’t go back: you must remain in the essay section.

In the essay section, you must complete 8-10 written response or calculation questions based on 2 scenarios describing a typical business situation.

the topics of each CMA Part 1 content area.

In this section, you’ll be required to know the items in these documents and how they relate to each other:

If you have studied any accounting before, this should be a relatively straightforward section, and most of these questions should be computational.

Budgeting is the biggest section of Part 1. You’ll be expected to calculate various items such as the cost of goods sold, cost of goods manufactured, and other items in the budget. You’ll also see some conceptual questions such as the definition of budgeting. The coverage of section B is more in-depth than that of section A. The concepts are not difficult, but questions can get lengthy and complex in some budgeting scenarios.

In this section, candidates are tested on the ways performance is evaluated in a corporation. Most of the evaluation tools should be familiar to those who work in the accounting department of a corporation. There are certain elements, such as standard costs, that are used mostly in manufacturing companies as opposed to service-oriented companies. If you are working in a financial institution or other service companies, you may want to spend more time understanding the standard cost concept.

The focus of this section includes the various costing methodologies, and you are expected to be able to complete a full set of calculations.

The internal control questions in this section are almost all conceptual. They are not difficult to understand, but they can be ambiguous. Picking the best answer can be pretty hard when a few of the answers seem to be somewhat correct. Don’t’ get frustrated if you breeze through this section but discover that you do poorly on the practice questions. It happened to me back then, but things started to click after I stayed focused and reworked the tough questions that I got wrong.

This section of Part 1 is new, so we have yet to develop a strategy for it. However, as with the other areas of the CMA exam, you may be able to use life experience as the foundation for your knowledge. Yet, you should still study the concepts in your CMA review course to ensure that your knowledge is deep. You don’t want to underestimate any part of the CMA exam.

The Institute of Management Accountants, abbreviated as the IMA, is a volunteer member association that is focused on meeting the needs of management accounting professionals. The IMA was founded in 1919 and states that its mission is to “provide a forum for research, practice development, education, knowledge sharing, and the advocacy of the highest ethical and best business practices in management accounting and finance.” So, what does all that mean?

In short, the IMA sets the ethical and professional standards for CMAs and maintains an investigative and discipline system to enforce these ethics requirements. If you want to become a CMA, you need to follow their initial requirements for entry. You will also need to maintain their standards and educational requirements to keep your CMA over time.

Many people have to decide between becoming a Certified Management Accountant (CMA) and getting a Master of Business Administration – also known as an MBA.

The CMA is an industry-recognized professional designation focused on management accounting, while the MBA is an academic degree, covering a broader scope of finance units.

Both the CMA and MBA are postgraduate options. The CMA is more specialized than the MBA. The CMA is a certificate, whereas the MBA is a Master’s qualification. The MBA takes two years, while the CMA take six months.

Unlike the MBA in which employers might judge the reputation of the university where you studied, the CMA exam is an industry-designated exam that is only issued through one institution. The CMA is also self-taught so candidates can study and prepare at their own pace using review courses. They can also be working in the industry at the same time.

The CMA is much less expensive than the MBA program. Although the MBA is a means to advance one’s career, due to its high costs, one should consider the ROI.

The CMA requires on-going membership and reflects a certain level of subject matter knowledge and skills. On the other hand, the MBA is a university degree.

According to Mythri David; The demand for CMAs in India is increasing with the arrival of MNCs and flow of off-shore establishments into our country.

Finance manager / Internal Auditor / Senior Executive / Business Analyst / Pricing Analyst / Director- Finance / Chief Financial Officer (CFO)

Finance manager earns an average salary of Rs 9.3L per year. Most people with this job move on to other positions after 20 years in this field. The skills that increase pay for this job the most are Senior Financial Management, Accounts Payable, Financial Modeling, and Budgeting.

Salary : 3.8L – 17.6L

Bonus : 7K – 2.5L

Profit Sharing : 0- 1.7L

Commission :0 – 19K

Total Pay : 4.3L – 19.2L

Financial Controller earns an average salary of Rs 18L . A skill in Senior Financial Management is associated with high pay for this job. Most people with this job move on to other positions after 20 years in this field.

Salary -6L-34L

Bonus- 12K – 5.9L

Profit sharing 0- 5.1L

Total pay – 6.2L-39L

Cost Accountant earns an average salary of 4.13L per year. Most people move on to other jobs if they have more than 10 years’ experience in this field. A skill in SAP SAP Financial Accounting and Controlling (SAP FICO) is associated with high pay for this job. Experience strongly influences income for this job.

Salary – 1.7L -9.8L

Bonus- 2K-1.02L

Profit Sharing – 0 -1.03L

Total Pay – 1.8L – 1.03L

Chief Financial Officer (CFO) earns Rs 29L p.a Most people in this job have more than five years’ experience in related jobs. The highest paying skills associated with this job are Business Strategy, Strategic Planning, Fundraising, Budget Management, and Financial Analysis. Experience strongly influences salary for this job.

Salary – 8.9L – 63L

Bonus – 8K- 12L

Profit Sharing – 0 – 24L

Total pay – 9.7L-72L